RealTest vs MetaTrader-5: Comparing Backtesting Software for Systematic Trading

If you’re serious about building a systematic trading strategy, choosing the right backtesting software could mean the difference between confidence and chaos.

So which tool gives you the edge: RealTest or MetaTrader 5 (MT5)?

Short answer:

For serious systematic traders who want fast, realistic portfolio-level backtests, RealTest is the better backtesting software.

However, MT5 has broader broker integration and may suit traders who are heavily focused on discretionary trading or automated execution in forex.

Let’s break down why that is.

RealTest vs MetaTrader-5 at a Glance

Short on time? Here’s how RealTest and MetaTrader-5 compare side by side.

|

Feature |

RealTest |

MetaTrader 5 (MT5) |

|

Operating System |

Windows (can run on Mac via Parallels) |

Windows, Mac (via web), mobile, browser |

|

Cost |

Paid: $389 license + Optional $159/year update |

Free via most brokers |

|

Programming |

Simple scripting (spreadsheet-like logic) |

MQL5 (advanced, C-like) |

|

Portfolio Backtesting |

True multi-strategy, multi-symbol support |

Limited, mostly symbol-by-symbol |

|

Execution |

Partial automation (export to brokers) |

Fully integrated auto-execution with brokers |

|

Documentation |

Clean, modern, educational |

Dense, fragmented, developer-focused |

|

Learning Curve |

Low to moderate |

Moderate to high |

|

Charting |

Basic |

Advanced interactive charts |

|

Community & Support |

Developer supported + active Discord |

Vast community but inconsistent quality |

Platform Overview, Cost & Compatibility

RealTest is a standalone Windows-based trading and backtesting software developed specifically for systematic traders. It’s lightweight, extremely fast, and designed for traders who want confidence in their systems without coding complexity.

MetaTrader 5, on the other hand, is a multi-asset trading platform primarily used for forex and CFD trading. It’s offered free by most brokers, but you pay for it in other ways (like spreads, plug-ins, or data restrictions).

- RealTest: $389 upfront + $159/year for updates

- MT5: Free, but broker-dependent and less transparent

Both can be used on Mac via Parallels. Wine is not recommended due to instability.

RealTest Main View:

MetaTrader-5 Main View:

Market Access & Data Support in RealTest and MetaTrader-5

RealTest works with end-of-day (EOD) data from Norgate Data and ASCII files. It supports global stock markets including ASX, US, Hong Kong, TSX – perfect for multi-market system trading.

MT5 supports real-time and historical data mainly from forex, CFD, crypto and broker feeds. Market access is limited to what your broker provides.

- If you’re a multi-market equity trader: RealTest wins

- If you’re trading FX with one broker: MT5 may suffice

RealTest Backtesting Interface:

MetaTrader-5 Backtesting Interface:

Building & Customizing Trading Strategies

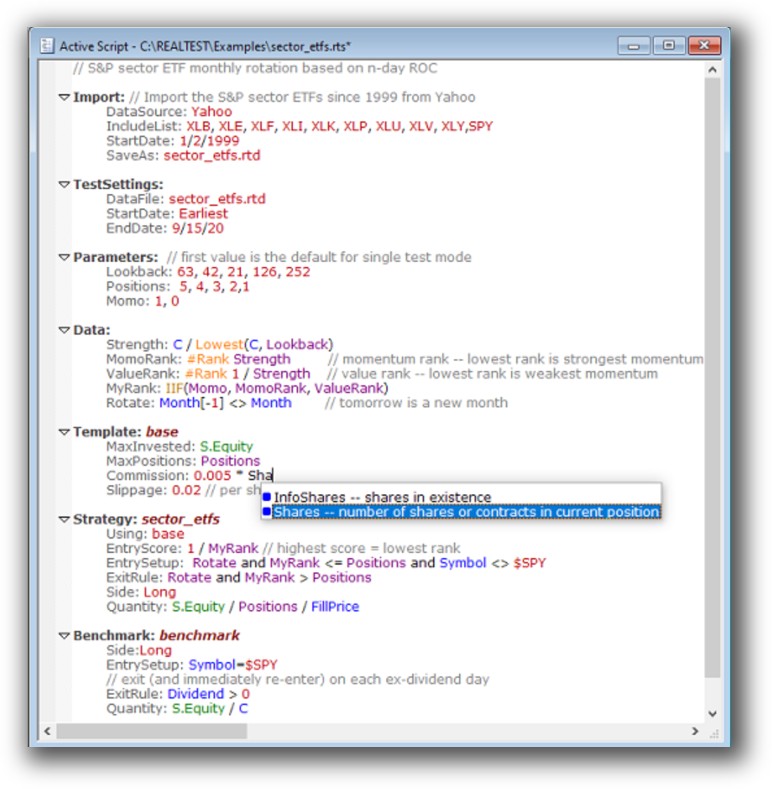

RealTest is built for logic-first traders. You define systems in a spreadsheet-like script, run portfolio-level tests, and iterate quickly.

MT5 uses MQL5, a powerful but complex coding language. It’s built more for developing Expert Advisors (EAs) and scripts in forex/CFD environments.

- RealTest: Write rules in plain text, test instantly, focus on logic

- MT5: Write full code, compile, debug, and test per symbol

If you value speed, simplicity, and system clarity, RealTest is a better fit.

Check Out: Trading System Development

RealTest Code Editor:

MetaTrader-5 Code Editor:

Backtesting Performance, Speed & Realism

This is where RealTest shines.

- RealTest offers true portfolio-level backtesting with position sizing, capital constraints, rebalancing, and multi-system simulations. You can simulate real-world slippage, commission, and account size dynamics with stunning speed.

- MT5, while technically capable, runs symbol-by-symbol and lacks the realism of managing multiple systems on one account.

Want to simulate a real trading account with 5 strategies running in parallel across global markets?

Only RealTest can do that without extreme workarounds.

Portfolio-level simulation is essential if you want to trade a diversified portfolio of strategies.

Check out: Backtesting | Drawdown

RealTest Backtest Report:

MetaTrader-5 Backtest Report:

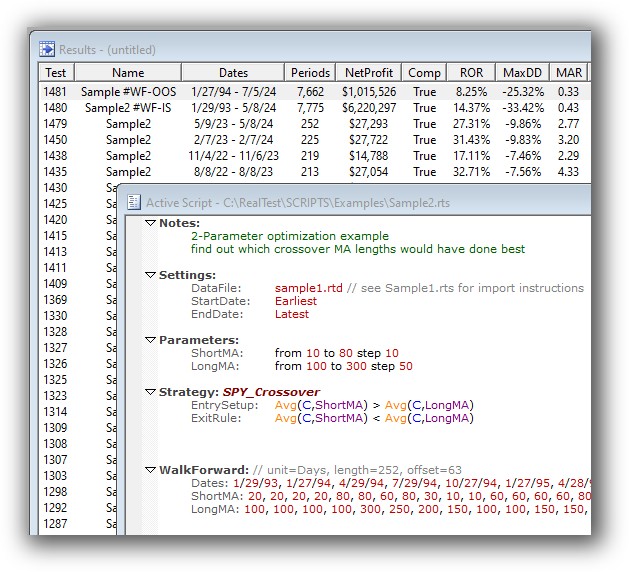

Strategy Optimization & Stress Testing Tools

MT5 includes built-in optimization, walk-forward testing, and even machine learning options for EA tuning. However, most traders fall into the trap of curve fitting without understanding robustness.

RealTest takes a different approach:

- Manual parameter testing

- Built-in tools for evaluating robustness

- Encourages stability over profit peaks

This means you actually learn to think like a professional trader, not just click “optimize.”

For traders who value confidence and clarity over complexity, RealTest is the stronger choice.

Check Out: Trading System Optimization

RealTest Walk Forward Testing:

Charting Features, Signal Exploration & Live Execution

MT5 wins on charting. It has:

- Multi-timeframe charts

- Advanced indicators

- Drawing tools

- EA integration with brokers

RealTest has basic charts for visualizing signals and trades, but charting isn’t its core strength.

Execution-wise:

- MT5 can automate via brokers using EAs

- RealTest exports orders (e.g. to Interactive Brokers) but doesn’t place trades directly

Use RealTest for system development and portfolio backtesting, and connect to MT5 or other platforms for live execution if needed.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

MetaTrader-5 Automation Set Up:

Support, Documentation & Learning Resources

RealTest’s documentation is modern, focused, and easy to follow. It includes:

- Code examples

- System templates

- Tutorials from the developer

MT5 has a massive knowledge base, but it’s scattered across forums, videos, and developer blogs. It’s overwhelming and often out of date.

RealTest also has an active Discord community, which makes it easier to learn alongside other systematic traders.

If you’ve ever felt stuck trying to decode cryptic documentation, you’ll appreciate RealTest’s clarity.

RealTest Forum is illustrated down below:

MetaTrader-5 Forum is illustrated down below:

RealTest vs MetaTrader-5: Which One Should You Use?

If you’re focused on:

- Trading multiple systems

- Testing realistic portfolio behavior

- Keeping things simple and logical

- Spending less time and avoiding analysis paralysis

RealTest is the better backtesting software.

MT5 has its place, especially for:

- Forex traders wanting full automation

- Traders who love charts and indicators

- Short-term discretionary traders

But for analytical thinkers who want to build confidence and consistency through systems, RealTest provides the most direct path.

Our Recommendation

We recommend using RealTest for developing and testing systematic trading systems, especially if you trade stocks across multiple markets.

Use MT5 only if:

- You trade FX or CFDs

- You need broker-integrated automation

- You’re comfortable with complex scripting

Even then, RealTest can still be your research platform

Want the Rest of the Puzzle?

Choosing the right backtesting software is just one part of becoming a confident, consistent trader.

To complete the puzzle, you also need:

- Complete trading systems

- Portfolio-level diversification

- Position sizing logic

- The ability to trade with calm, not chaos

That’s exactly what we cover in The Trader Success System – the comprehensive program designed to help you build wealth through systematic trading.

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)