RealTest vs NinjaTrader: Comparing Backtesting Software for Systematic Trading

If your goal is to trade systematically with clarity, confidence, and time efficiency, RealTest is the better backtesting software. It’s faster, simpler, and purpose-built for traders who want to simulate portfolios and refine rule-based strategies without the noise. NinjaTrader, while powerful and great for futures traders who want integrated execution and advanced charting, it is more complex and less aligned with the needs of traders who want to stay focused on strategy validation and portfolio-level realism.

RealTest vs NinjaTrader at a Glance

Short on time? Here’s how RealTest and NinjaTrader compare side by side.

| Feature | RealTest | NinjaTrader |

|

Operating System |

Windows 64-bit (Mac via Parallels/Bootcamp) |

Windows only for desktop; Web & Mobile limited |

| Pricing |

One-time US$389 + optional updates ($159/yr) |

Free basic, Lease (US$720/yr), Lifetime (US$1,099) |

| Progamming Language |

Custom rule-based scripting (very readable) |

NinjaScript (based on C#/.NET) |

| Portfolio Backtesting |

Full multi-system, multi-symbol support |

Strategy Analyzer with limitations on realism |

| Optimization |

Rule-based logic, with optional brute-force |

Brute-force + genetic optimizations |

| Charting & Execution |

Minimal charts, export orders to IBKR |

Advanced charting, full execution via NinjaTrader broker |

| Documentation & Learning |

Clean, modern, actively maintained |

Developer-focused; fragmented documentation |

Platform Overview, Cost & Compatibility

RealTest is purpose-built for strategy simulation. It runs on 64-bit Windows and can be used on Mac via virtual machines like Parallels or Bootcamp (Wine is not recommended). There’s a one-time cost of $389 USD, with optional updates at $159/year, no platform lock-in, no brokerage requirement.

NinjaTrader offers a free base platform with limited functionality. To unlock key features (like advanced backtesting, automation, and order flow tools), you’ll need to lease or buy the software. Pricing ranges from $720/year to a $1,099 lifetime license. It’s Windows-only, with limited mobile/web functionality.

If you want clean ownership, no brokerage tie-ins, and full control, RealTest is more cost-effective and focused

RealTest Main View:

NinjaTrader Main View:

Market Access & Data Support in RealTest and NinjaTrader

RealTest is data-source agnostic. You can load data from Norgate, Yahoo, or your own CSV files. This makes it ideal if you’re trading stocks, ETFs, or crypto across multiple markets.

NinjaTrader, on the other hand, is tailored heavily toward futures traders. Market access is mostly via its own brokerage or third-party futures data feeds. Stock and forex support exists, but is less seamless.

If you’re trading portfolios of stocks or ETFs using your own data sources, RealTest gives you more flexibility and independence.

RealTest Backtesting Interface:

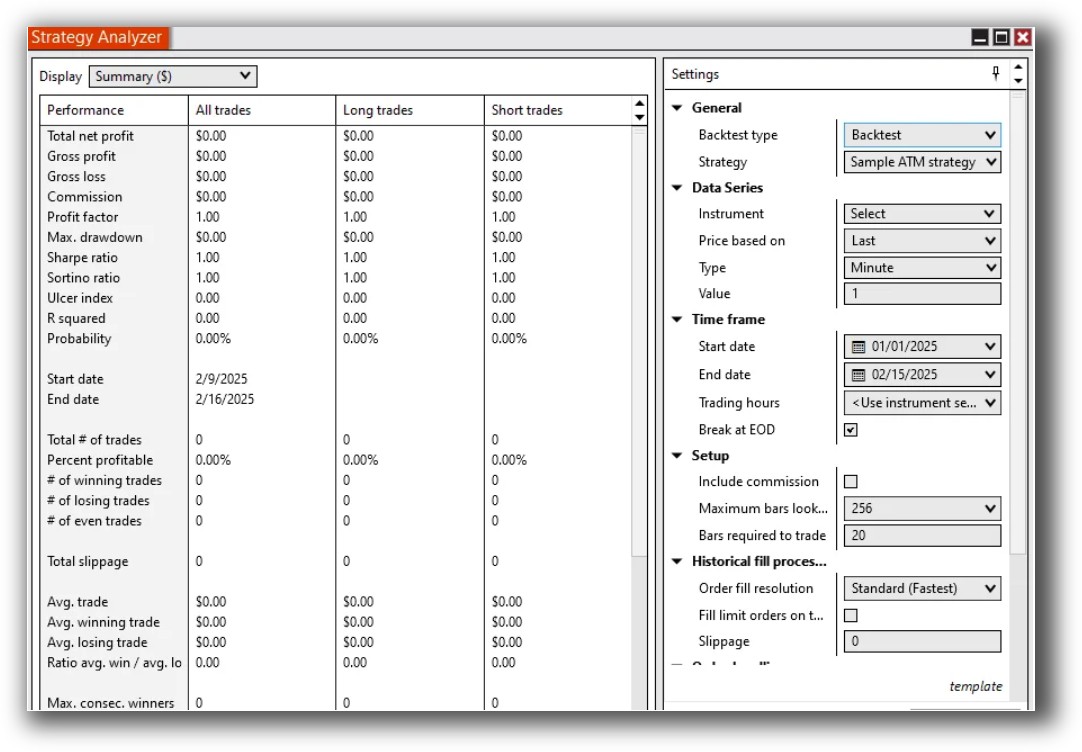

NinjaTrader Backtesting Interface:

Building & Customizing Trading Strategies

This is where RealTest shines for logical thinkers.

RealTest uses a declarative scripting approach. Strategies are written like a ruleset – clean, readable, and easy to adjust. There are no loops or confusing logic trees. If you’ve ever been frustrated trying to force logic into a programming language, this will feel refreshing.

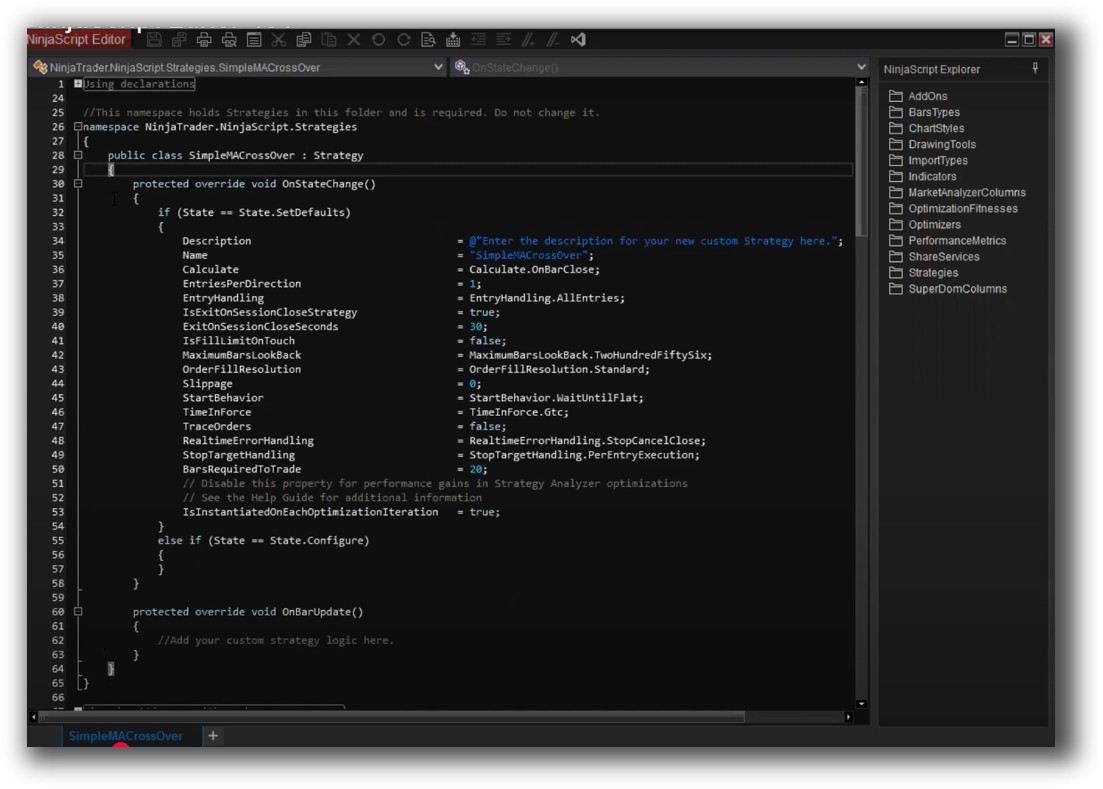

NinjaTrader uses NinjaScript, which is powerful, but based on C#/.NET. It is designed for developers, if you love to code and want deep control, it’s capable (but for non-programmers, it’s steep.)

For time-efficient strategy testing, especially for analytical traders who value clarity and precision, RealTest wins.

Check Out: Trading System Development

RealTest Code Editor:

NinjaTrader Code Editor:

Backtesting Performance, Speed & Realism

RealTest is built for speed and realism:

- Position sizing

- Capital constraints

- Strategy coordination

- Accurate slippage & execution modeling

You get a true portfolio-level simulation, not just single-strategy backtests. This is critical if you’re running multiple systems, trading with real capital, and want to model what actually happens in live trading.

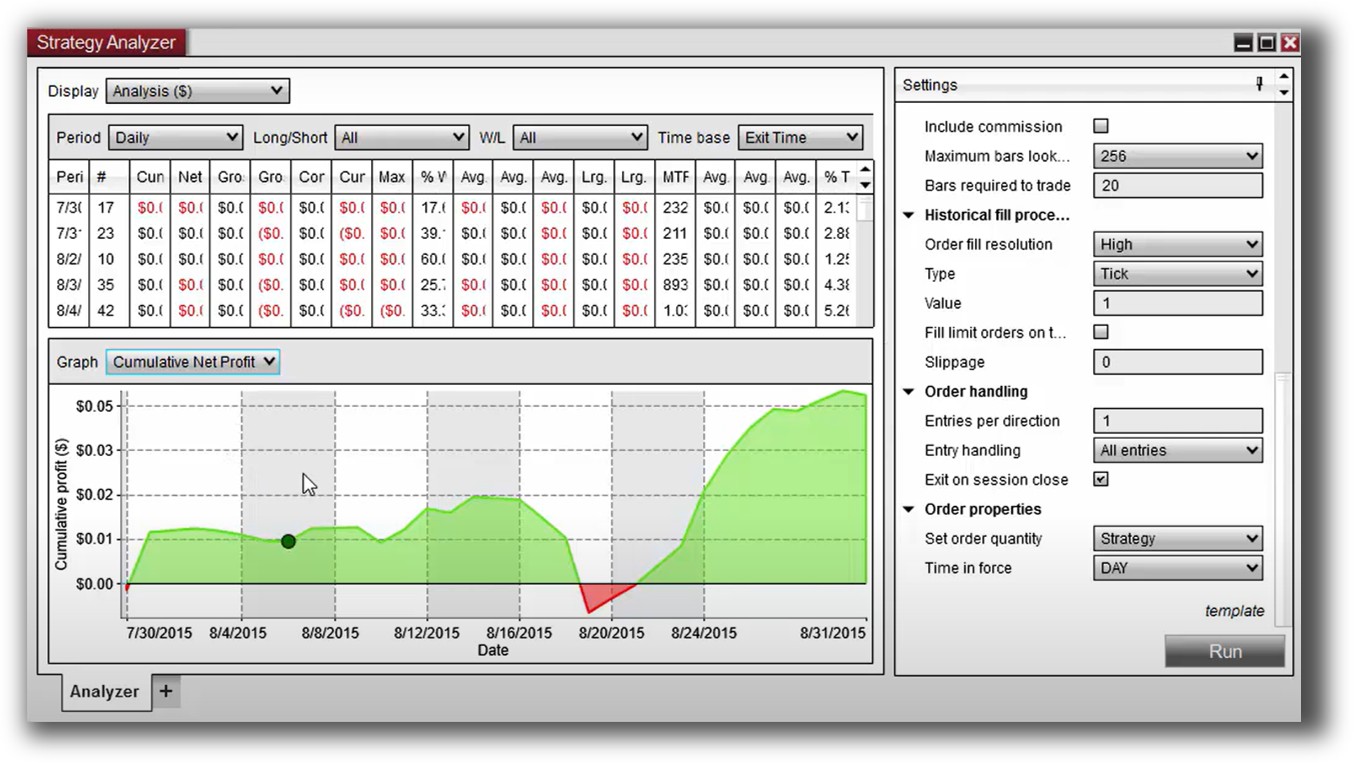

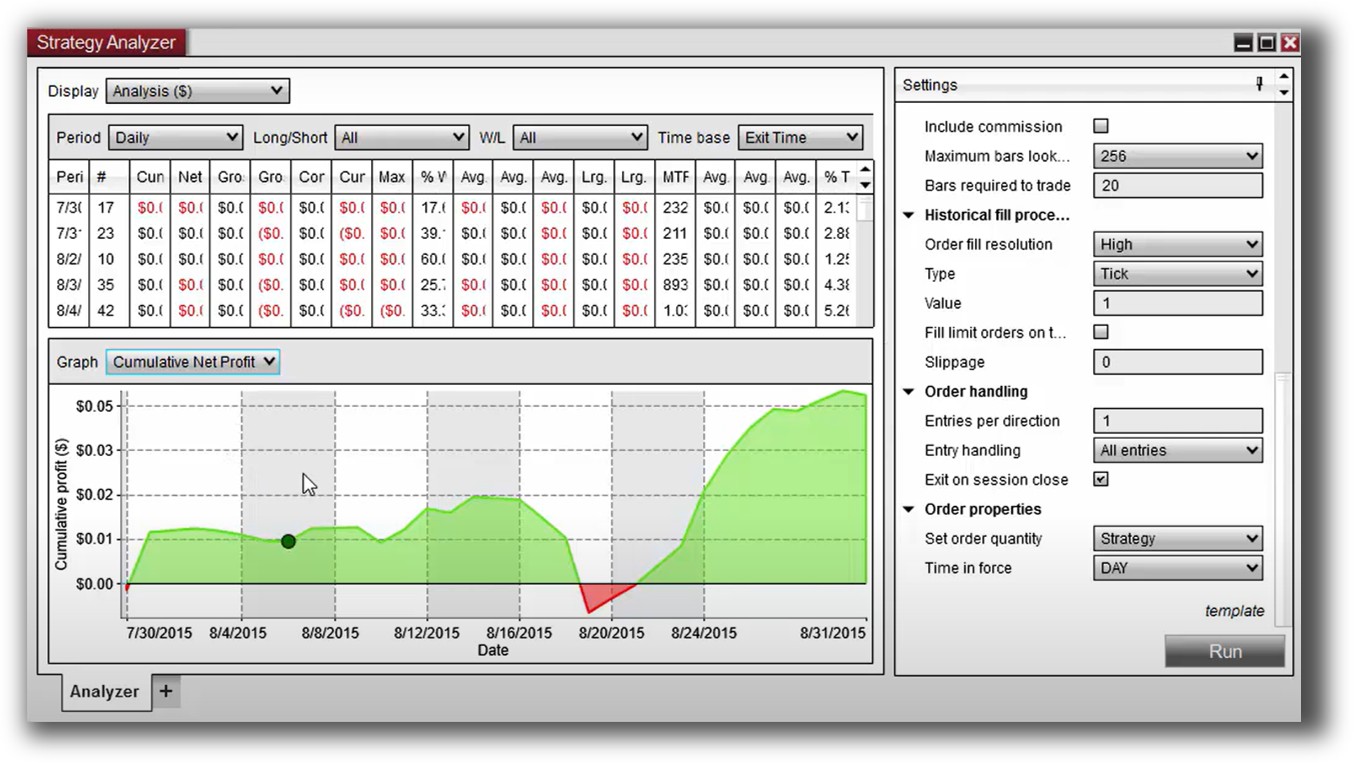

NinjaTrader’s Strategy Analyzer works well for single-symbol or strategy-focused testing, but it’s limited in terms of portfolio realism. Position sizing, slippage, and capital constraints can be added, but not as intuitively.

If you’re building portfolios of systems and want realistic, reliable results, RealTest is better designed for the job.

Check out: Backtesting | Drawdown

RealTest Backtest Report:

NinjaTrader Backtest Report:

Strategy Optimization & Stress Testing Tools

NinjaTrader includes brute-force and genetic optimization tools out of the box. These can be powerful, but also risk overfitting if used blindly.

RealTest promotes a logic-first approach. You define rule variations manually, then test them in structured batches. This avoids the trap of blindly optimizing hundreds of parameter combinations that “look good” but fail in live trading.

If you’re serious about robustness, simplicity, and avoiding overfitting, RealTest keeps you focused on what matters – rules that make sense and strategies that hold up.

Check Out: Trading System Optimization

RealTest Walk-Forward:

Charting Features, Signal Exploration & Live Execution

-

RealTest intentionally keeps charting minimal. It includes enough to visually validate trades, but it’s not your scanning or execution dashboard.

In terms of execution:

- RealTest exports order files to brokers like Interactive Brokers

- NinjaTrader is a full brokerage platform, with integrated order routing, automation, and trade management

If you’re actively trading futures or want all-in-one execution, NinjaTrader has the edge. But if you want clean separation between strategy development and execution, RealTest supports a more robust workflow.

Check Out Order Types | Automated Trading Systems

RealTest Automation Set Up:

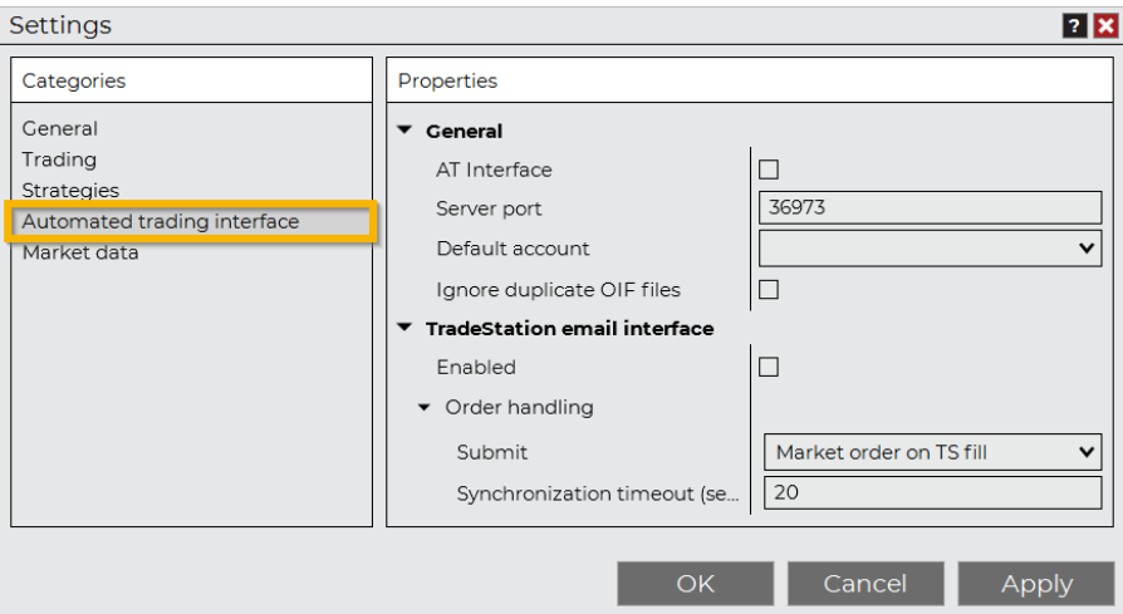

NinjaTrader Automation Set Up:

Support, Documentation & Learning Resources

RealTest has clear, modern documentation and an actively maintained knowledge base. The developer, Marsten Parker, is accessible and responsive in support forums.

NinjaTrader’s documentation is developer-focused and spread across user guides, forums, and legacy tutorials. While there’s a large user community, finding answers can take more time.

If you value clear, logical learning paths, RealTest makes the process smoother.

RealTest Forum is illustrated down below:

NinjaTrader Forum is illustrated down below:

RealTest vs NinjaTrader: Which One Should You Use?

If you’re a systematic trader looking for clarity, control, and a true representation of real-world trading, RealTest is the better backtesting software.

It’s lighter, faster, and specifically designed to help you validate and refine strategies at the portfolio level, without the overhead of a brokerage platform or unnecessary distractions.

NinjaTrader is a strong choice for futures traders, discretionary setups, or those who want advanced charting and direct execution. But for systematic stock traders focused on strategy testing and automation, it often adds complexity without meaningful benefit.

Our Recommendation

At Enlightened Stock Trading, we teach you to become a confident, consistent, and systematic trader – not someone reliant on flashy charts or endless indicator tweaking.

That’s why we recommend RealTest for traders who want to build lasting trading success.

-

It suits analytical traders who want deep insights into their trading strategies

-

It saves time by streamlining the entire development and testing process

-

It helps you build and evaluate multiple systems quickly and accurately

When you combine RealTest with our structured mentoring and proven frameworks inside The Trader Success System, you’ll go from overwhelmed to consistent – fast.

Want the Rest of the Puzzle?

Backtesting software is just one piece of your journey.

To trade with consistency and confidence, you also need:

- A proven trading system

- Portfolio-level thinking

- Robust risk management

- Community and mentoring

- Time-efficient tools and workflow

That’s exactly what we deliver in The Trader Success System.

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)