Wealth-Lab VS BeyondCharts: Comparing Backtesting Software for Systematic Trading

If you’re a serious trader looking to build, test, and automate robust systematic strategies, Wealth-Lab offers greater flexibility, extensibility, and realism than Beyond Charts. Beyond Charts can be useful for discretionary charting and simple systems, but it lacks the portfolio-level simulation, automation potential, and modern development environment required for true system trading. Traders who value realism and speed in their backtests should also consider RealTest, which is preferred for its efficiency and ease of use.

Wealth-Lab VS BeyondCharts at a Glance:

Short on time? Here’s how Wealth-Lab VS Beyond Charts compare side by side.

|

Feature |

Wealth-Lab |

Beyond Charts |

|

Platform |

Windows (.NET) |

Windows (no brokerage integration) |

|

Cost |

Subscription (US $39.95/mo or $299.95/yr) |

One-time license (AUD $595 incl. GST) |

|

Strategy Language |

WealthScript (C#) + drag-and-drop builder |

BCFL (custom formula language) |

|

Brokerage Integration |

Yes (IB, Tradier, etc.) |

No |

|

Portfolio Backtesting |

Yes (multi-strategy simulation) |

No |

|

Charting |

Yes |

Yes |

|

Automation |

Yes (via extensions or scripting) |

No |

|

Operating System Compatibility |

Windows only |

Windows only |

|

Mac Compatibility |

Via Parallels / VM (not native) |

Via Parallels / VM (not native) |

|

Documentation |

Active and detailed |

Outdated and limited |

Platform Overview, Cost & Compatibility

Wealth-Lab integrates with several brokers and data providers including Interactive Brokers, Tradier, and Alpaca, among others. This allows live trading and historical data access directly from the platform.

Beyond Charts does not offer broker integration. It relies on external data feeds or manual import, which is less practical for those building automated or multi-market strategies.

Wealth-Lab Main View:

Beyond Charts Main View:

Market Access & Data Support in Wealth-Lab VS BeyondCharts

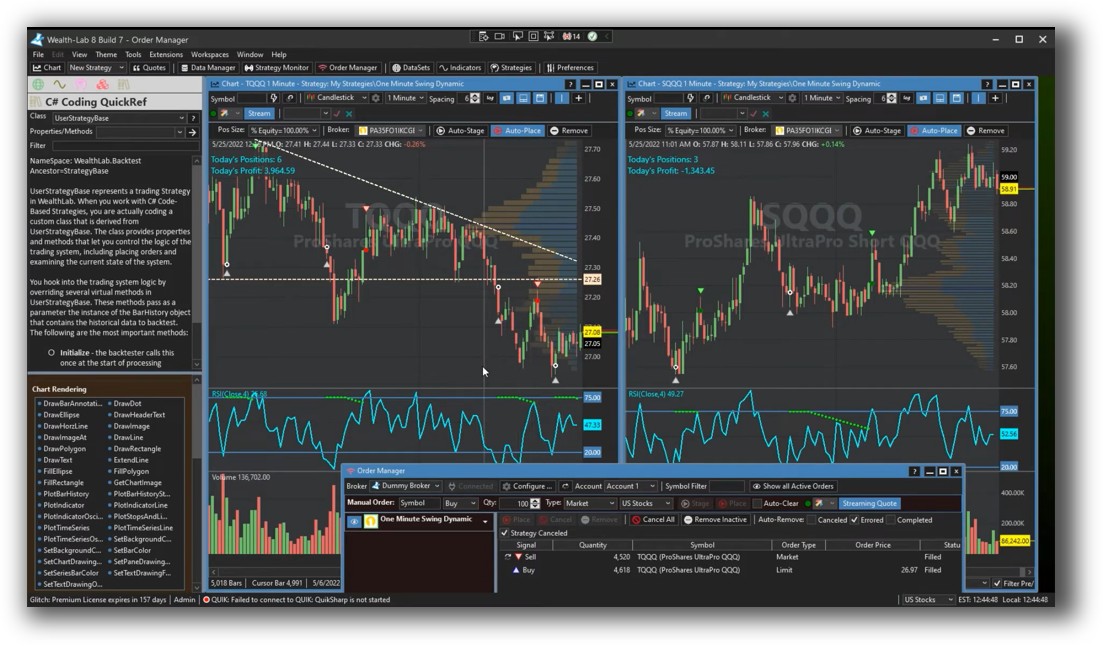

Wealth-Lab supports two primary workflows:

- A drag-and-drop rule-based strategy builder (ideal for non-coders)

- A full C# scripting environment (WealthScript) for advanced traders

This gives it a broad appeal. Beginners can visually test systems, while experienced traders can code powerful logic using a full programming language.

Beyond Charts uses its own formula language (BCFL). While useful for simple strategies, it lacks the depth and flexibility of C# or Python. Traders looking to test portfolio-level rules or advanced logic may quickly outgrow BCFL

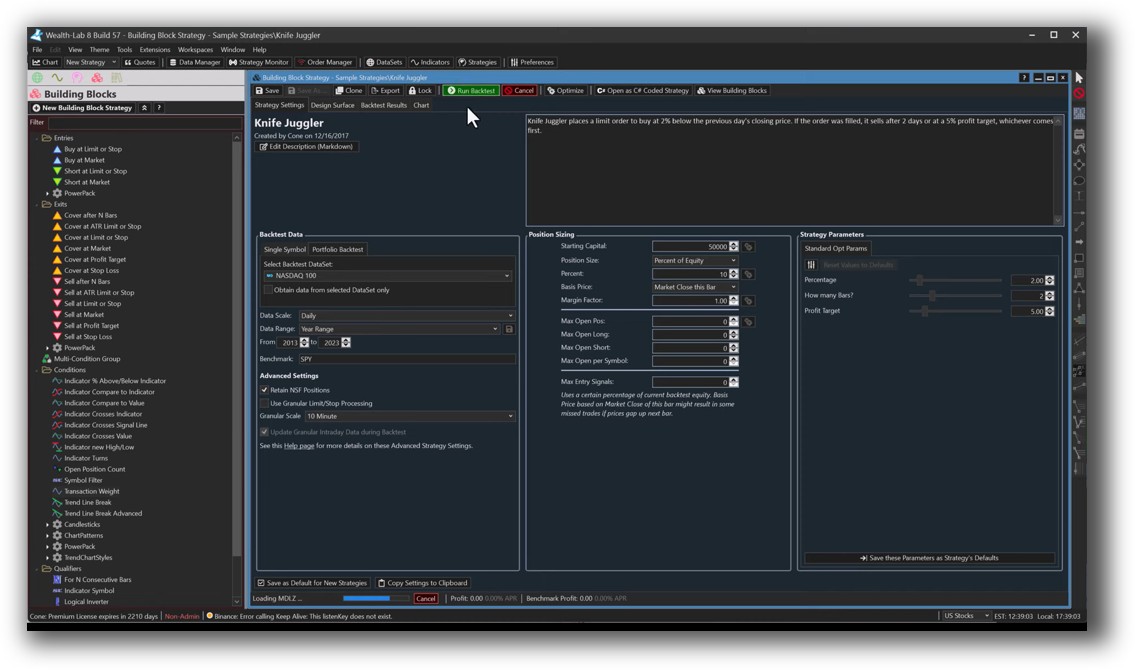

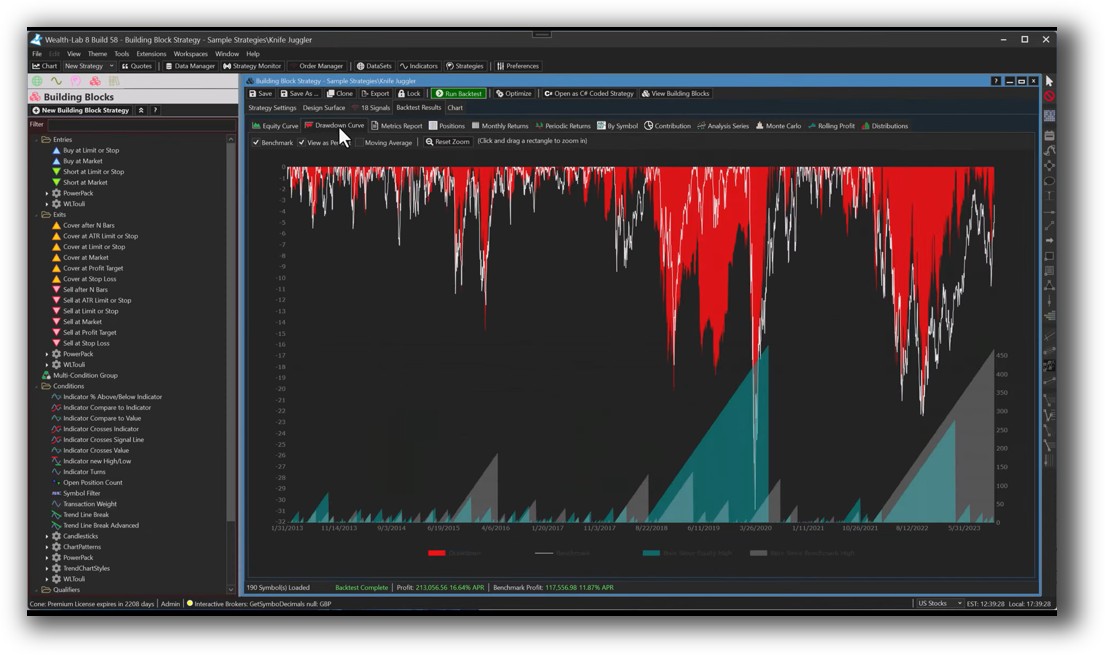

Wealth-Lab Backtesting Interface:

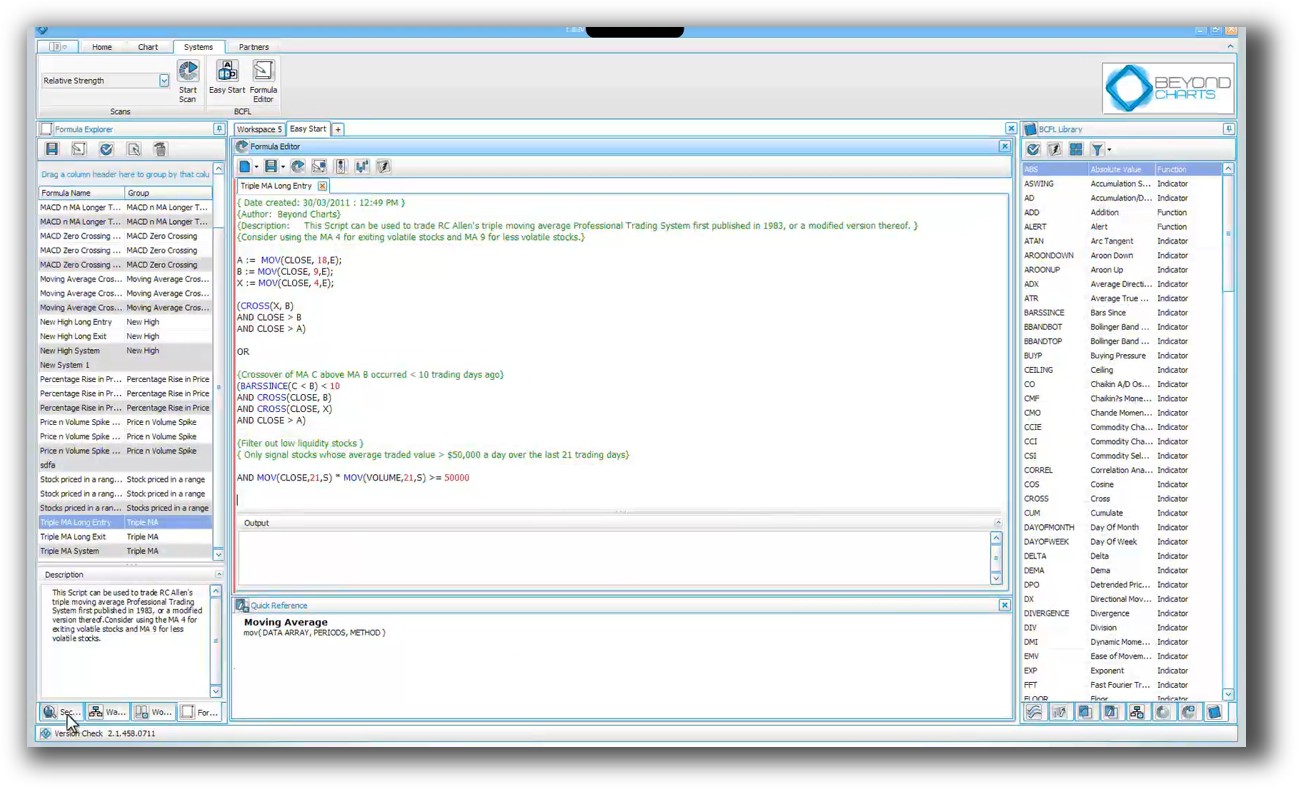

Beyond Charts Backtesting Interface:

Building & Customizing Trading Strategies

This is where Wealth-Lab clearly pulls ahead. Its backtest engine is capable of multi-strategy, multi-symbol portfolio simulations with realistic position sizing, slippage, and commission modeling.

Beyond Charts does not support portfolio-level backtesting. This is a serious limitation for systematic traders who want to diversify across strategies and markets.

If you’re still manually checking one chart at a time or running isolated backtests, you’re burning hours and building an illusion of control. Systematic trading is about realistic simulation, not perfect hindsight.

Check Out: Trading System Development

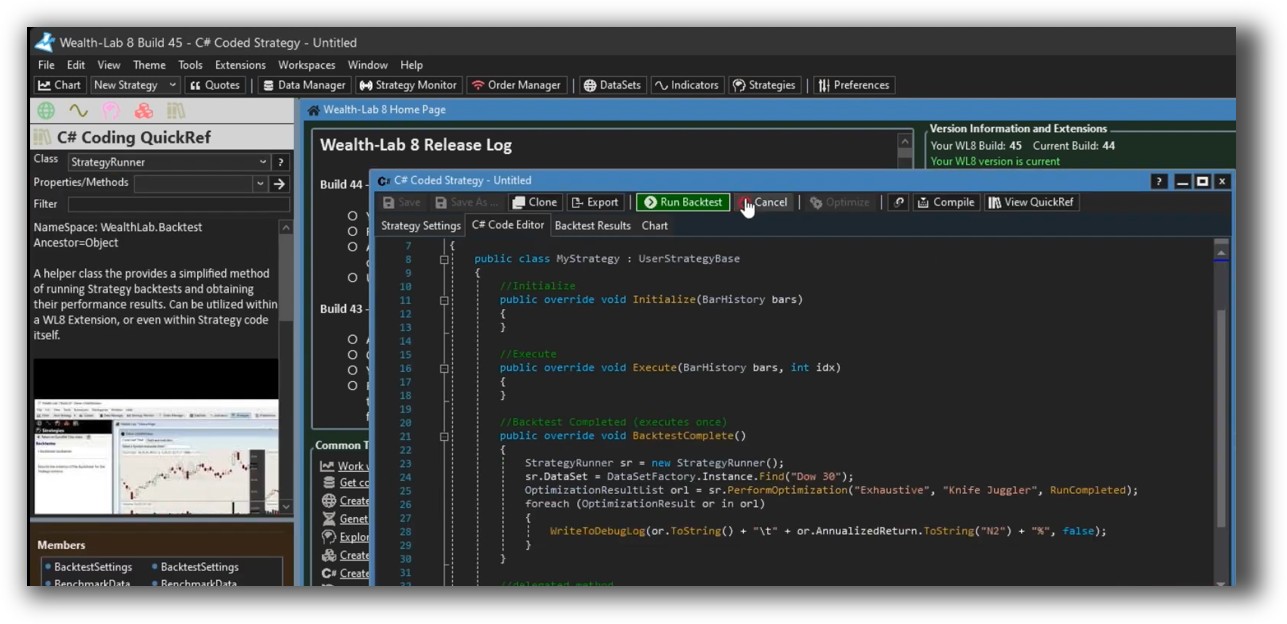

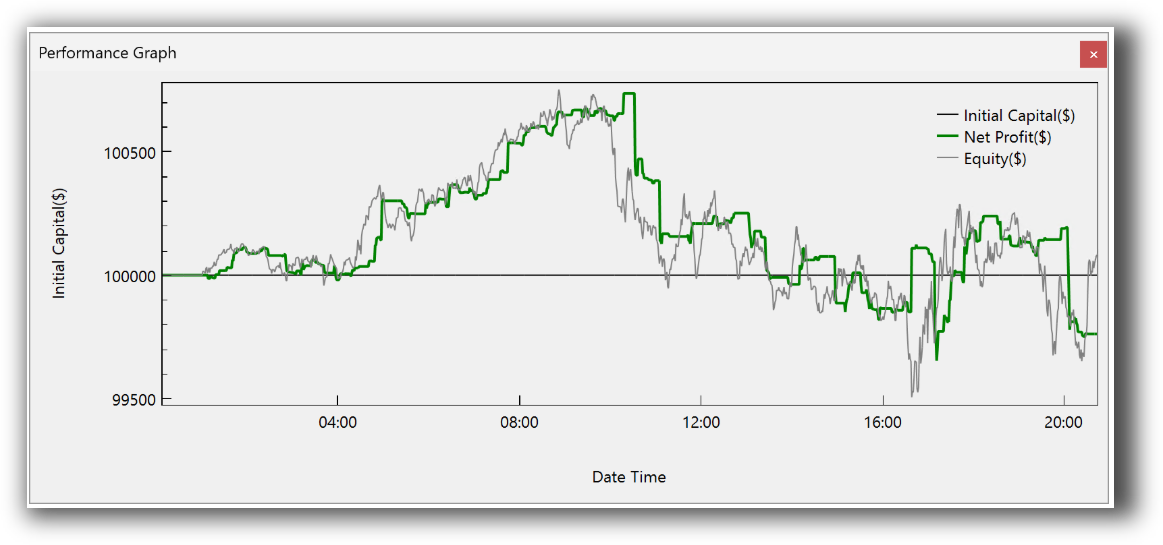

Wealth-Lab Code Editor:

Beyond Charts Code Editor:

Backtesting Performance, Speed & Realism

This is another area where Wealth-Lab pulls ahead. Its backtesting engine is capable of multi-strategy, multi-symbol portfolio simulations with realistic position sizing, slippage, and commission modeling.

Beyond Charts does not support portfolio-level backtesting. This is a serious limitation for systematic traders who want to diversify across strategies and markets.

If you’re still manually checking one chart at a time or running isolated backtests, you’re burning hours and building an illusion of control. Systematic trading is about realistic simulation, not perfect hindsight.

Check out: Backtesting | Drawdown

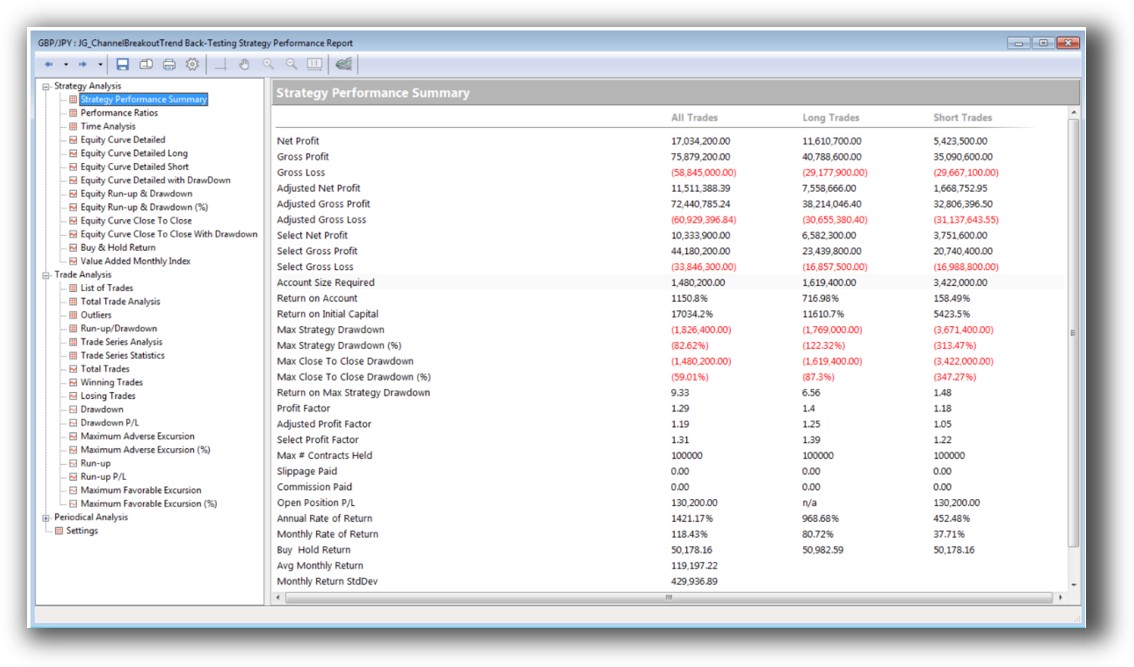

Wealth-Lab Backtest Report:

Beyond Charts Backtest Report:

Strategy Optimization & Stress Testing Tools

Wealth-Lab includes built-in parameter optimization tools with visualizations, walk-forward analysis, and Monte Carlo testing. This allows you to test system robustness before risking real capital.

Beyond Charts does not support optimization or robustness testing natively. This means you’re limited to fixed input parameters and may fall prey to curve fitting without realizing it.

In system trading, this is a deal breaker. Without robustness testing, you’re just backfitting noise and calling it alpha.

Check Out: Trading System Optimization

Wealth-Lab Walk-Forward Optimization:

Charting Features, Signal Exploration & Live Execution

Both platforms offer charting and scanning. Wealth-Lab’s charts are functional but not as polished as some standalone charting platforms. That said, it supports advanced strategy overlays and trade visualization.

Beyond Charts has traditionally been known for its charting tools, especially for discretionary traders. Its scanning tools are decent but lack the power of modern scripting or automation.

Execution-wise, Wealth-Lab wins again. It can automatically place trades via broker integration. Beyond Charts does not support execution, which means you’re stuck copying trades manually.

Check Out Order Types | Automated Trading Systems

Wealth-Lab Automation Set Up:

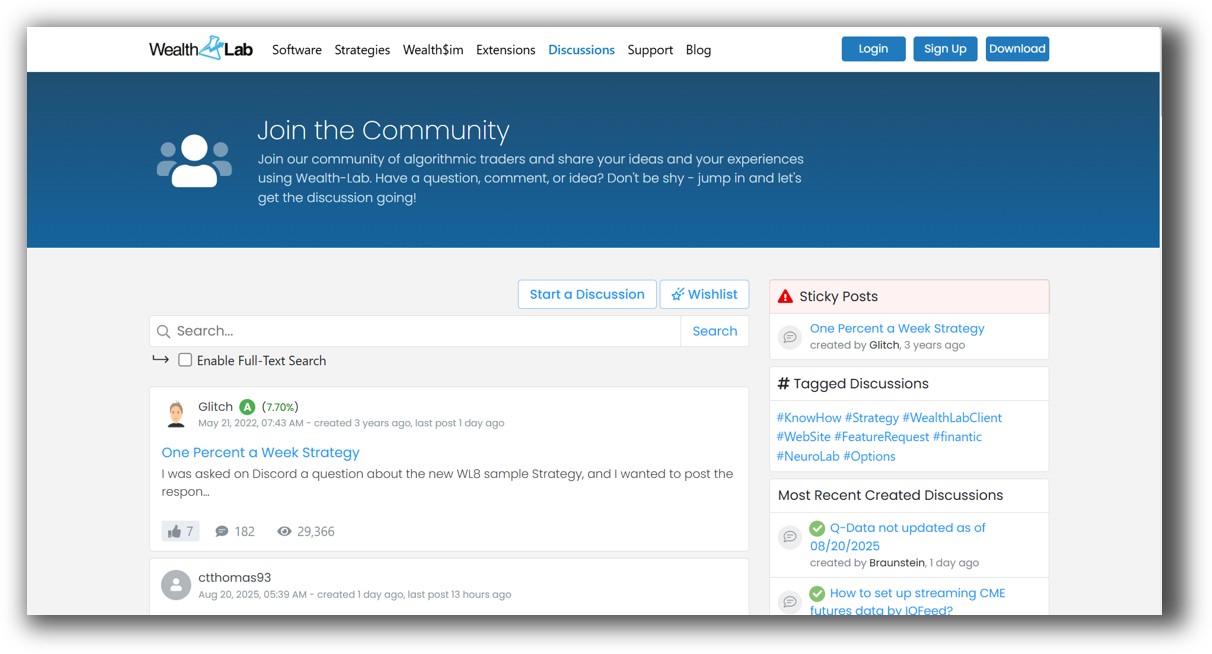

Support, Documentation & Learning Resources

Wealth-Lab’s documentation is detailed, searchable, and regularly updated. Its active user forums and support from the development team make onboarding easier, especially if you’re coding.

Beyond Charts, on the other hand, suffers from outdated documentation and minimal support. New users may struggle to learn the platform without third-party help.

Traders shouldn’t have to reverse engineer their own tools. If you’re spending more time figuring out how your platform works than testing systems, something’s wrong.

Wealth-Lab Forum Front Page is illustrated down below:

Beyond Charts Forum Front Page is illustrated down below:

Wealth-Lab VS BeyondCharts: Which One Should You Use?

Wealth-Lab is better suited for serious traders who want to develop, test, and automate systematic strategies. It offers better flexibility, deeper functionality, and a more modern development experience.

Beyond Charts may serve a purpose for discretionary chart watchers or those seeking a simple stock screening tool. But for system traders, it’s not enough.

If you’re looking for even more backtest realism, better code structure, and faster portfolio simulation – RealTest is our top pick. While not part of this comparison, RealTest is faster and simpler for large-scale system testing.

Our Recommendation

If your goal is consistent profits through rules-based trading, use software that supports that goal. Between Wealth-Lab and Beyond Charts, Wealth-Lab is the stronger backtesting software for systematic traders.

However, if you’re focused on speed, portfolio simulation realism, and simplicity – explore RealTest. And if you’re looking to stop experimenting and start trading with confidence, there’s a better way forward.

Want The Rest of the Puzzle?

Backtesting software is just one piece. The real transformation happens when you align your tools, your systems, and your psychology with your goals.

If you’re tired of chasing tips and want to build wealth systematically, the next step is clear: The Trader Success System.

Inside, you’ll discover:

- Proven trading systems

- A step-by-step backtesting framework

- Position sizing tools

- Automation strategies that let you trade in 30 minutes or less

Trading and Backtesting Software Review List

- RealTest vs Amibroker

- RealTest VS TradeStation

- RealTest VS NinjaTrader

- RealTest VS MultiCharts

- RealTest VS Wealth-Lab

- RealTest VS Beyond Charts

- RealTest VS Optuma

- RealTest VS TradingView

- RealTest VS MetaTrader 4 (MT4)

- RealTest VS MetaTrader 5 (MT5)

- AmiBroker VS TradeStation

- AmiBroker VS NinjaTrader

- AmiBroker VS MultiCharts

- AmiBroker VS Wealth-Lab

- AmiBroker VS Beyond Charts

- AmiBroker VS Optuma

- AmiBroker VS TradingView

- AmiBroker VS MetaTrader 4 (MT4)

- AmiBroker VS MetaTrader 5 (MT5)

- TradeStation VS NinjaTrader

- TradeStation VS MultiCharts

- TradeStation VS Wealth-Lab

- TradeStation VS Beyond Charts

- TradeStation VS Optuma

- TradeStation VS TradingView

- TradeStation VS MetaTrader 4 (MT4)

- TradeStation VS MetaTrader 5 (MT5)

- NinjaTrader VS MultiCharts

- NinjaTrader VS Wealth-Lab

- NinjaTrader VS Beyond Charts

- NinjaTrader VS Optuma

- NinjaTrader VS TradingView

- NinjaTrader VS MetaTrader 4 (MT4)

- NinjaTrader VS MetaTrader 5 (MT5)

- MultiCharts VS Wealth-Lab

- MultiCharts VS Beyond Charts

- MultiCharts VS Optuma

- MultiCharts VS TradingView

- MultiCharts VS MetaTrader 4 (MT4)

- MultiCharts VS MetaTrader 5 (MT5)

- Wealth-Lab VS Beyond Charts

- Wealth-Lab VS Optuma

- Wealth-Lab VS TradingView

- Wealth-Lab VS MetaTrader 4 (MT4)

- Wealth-Lab VS MetaTrader 5 (MT5)

- Beyond Charts VS Optuma

- Beyond Charts VS TradingView

- Beyond Charts VS MetaTrader 4 (MT4)

- Beyond Charts VS MetaTrader 5 (MT5)

- Optuma VS TradingView

- Optuma VS MetaTrader 4 (MT4)

- Optuma VS MetaTrader 5 (MT5)

- TradingView VS MetaTrader 4 (MT4)

- TradingView VS MetaTrader 5 (MT5)

- MetaTrader 4 (MT4) VS MetaTrader 5 (MT5)