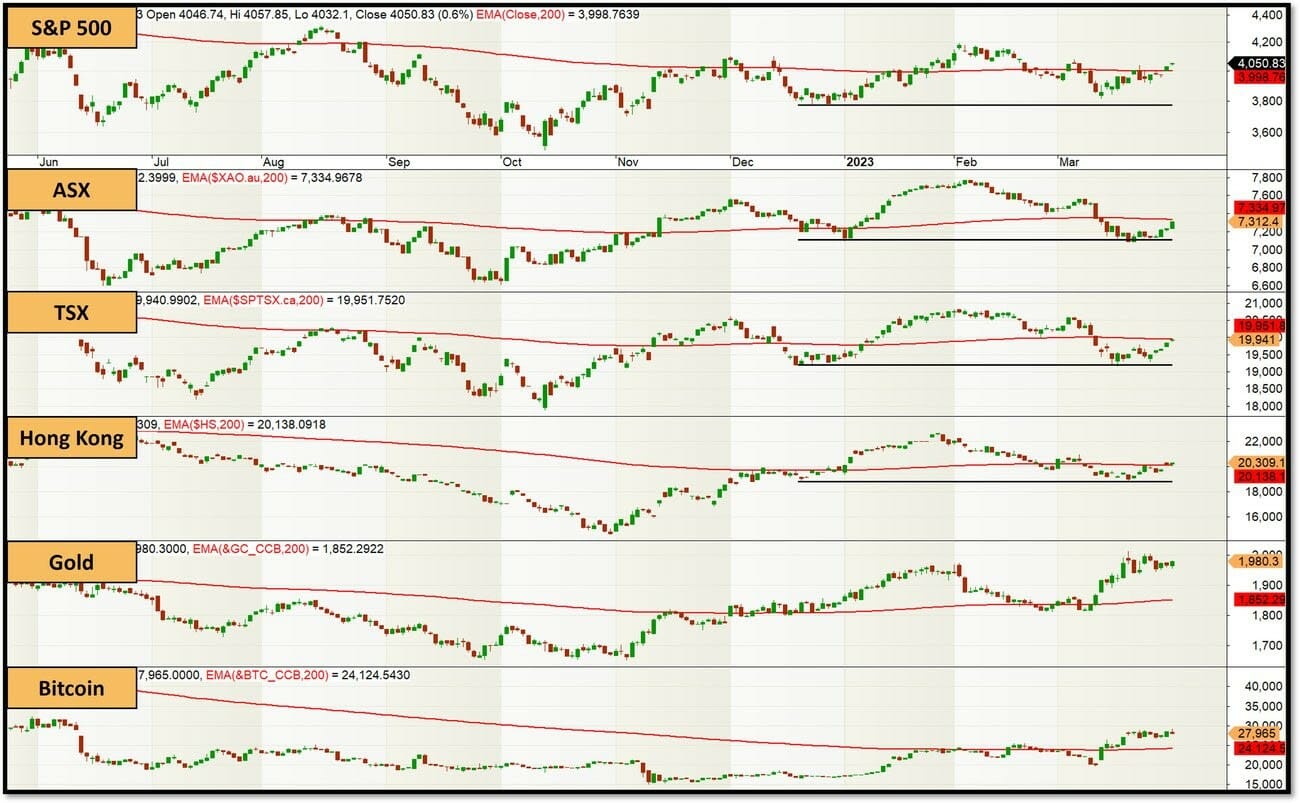

Welcome to this week’s Enlightened Trader Newsletter. Little has changed in the markets since my last update. The support levels on the major markets I follow have held so far but there was no real meaningful movement despite a few positive days this week. I would say we are still in a holding pattern waiting to see if there is another shoe to drop in the US banking saga.

The SP&500 just scraped over its 200-day EMA and the ASX, TSX and Hong Kong markets are not far behind. While I certainly don’t use that crossover as an entry signal, it is a useful regime filter because all of the worst market events tend to happen below the 200-day EMA.

Despite this, I am still net short US stocks and net long Aussie stocks… I had the strange situation a couple of days this week where I was profitable on my longs and my shorts on the same day… but don’t worry, that sort of behaviour never lasts 😆

As soon as the market picks a clear direction my systems will load up in that direction instead of playing around at the edges as they are now.

I have added the price of Gold and Bitcoin to the chart above this week because these markets are both more strongly bullish than stocks at the moment. This is despite the US regulators announcing a suit against Binance. I guess when you start cranking the printing presses again and ruining all your hard work to control inflation (thanks Fed… I love paying $6.50 for a coffee 🙄) then Gold and Bitcoin both benefit because they are both limited… unfortunately they are not perfect inflation hedges, but they are certainly showing some strength against inflation at the moment.

My crypto systems are loading up on the long side so will be interesting to see how that goes in the coming week.

Unfortunately what you can see in ALL of the charts above is that none of them are having decisive moves at the moment. This lack of trend is difficult for traders and many are just ignoring the markets, and many are disengaging altogether…

This is a mistake!

Periods of sideways action like this are frustrating, no doubt, but they are part of trading. Surviving them without pulling all your hair out or eating up your account with small losses is critical if you are to be a successful trader.

In fact, now is a perfect opportunity to ‘sharpen the saw’ and hone your skills. For example, my students in The Trader Success System have had the opportunity to learn how to build their own trading systems from scratch over the last 4 weeks in my Breakthrough Workshops. This is a vital skill for anyone who wants a long-term career trading the markets.

In difficult or boring times in the markets, the best way you can spend your time and energy is to double down on your learning so that you are ready to go (either Long or Short) as soon as the market really picks a direction.

If you are standing on the sidelines waiting for things to improve before learning how to trade systematically then I believe you are making a HUGE mistake because you are going to miss the decisive move when it does come!

Last week I spoke about the need for risk management, diversity, confidence and patience in times like these… we need to maintain patience and be poised (with the right systems) to take action as soon as the market chooses a direction.

In the spirit of diversification, I did an interesting investigation this week that I want to share with you… I tested a simple mean reversion trading system on 18 different stock markets around the world to see which markets have the most potential for mean reversion trading. Here are the equity curves:

The markets tested fall into several categories:

- Markets where mean reversion works exceptionally well (you may be surprised which ones)

- Markets where mean reversion previously worked but no longer does

- Markets that have some potential with a little system development work

- Markets where the strategy just doesn’t work

There is a lot of temptation for traders to stick to what they know – trading their home market. But what if your home market is one of the ones that does NOT perform well???

Global diversification gives you opportunities that most traders don’t have, and the great thing is it is not that complex – all you need are the systems, the data and the process to do it and it takes just 30 minutes a day to manage!

Click here to read the complete article “18 Global Stock Markets Tested for Trading Mean Reversion”

Trading Tip of the Week

Consistent with the above discussion, my trading tip this week is to constantly ‘Sharpen the Saw’.

This is especially true now, in these difficult market phases!

I was having a conversation with one of my Trader Success System members this week and I shared 4 observations I have made over the last 20+ years in the markets:

- Good times breed reckless traders

- Bad times ruin reckless traders

- Bad times breed solid traders

- Solid traders survive long term

What this means is that the best time to learn is NOW when things are HARD. By learning to survive these difficult and uncertain times, you will become a much stronger trader.

Contrast this with Crypto Bob.

Crypto Bob is a trader who learned during the last crypto bull market…

… he learned he could buy anything that was moving & make a ton of money

… he learned that the more leverage he uses the better

… he learned that scaling in was a great idea

… he learned that ‘Diamond Hands’ was the way to do it

… but then when the market turned he got decimated and lost everything.

Crypto Bob is still licking his wounds and wondering how to cover his losses.

Don’t be like Crypto Bob.

Learn to trade like a pro now, so you can survive anything the market throws at you in the future!

Comment “PRO” below and I will show you how.

Student of the Week

Last week I called out Phil in my member highlight because he had been putting in the work to develop his own stock trading system from the ground up. When I discussed member highlights from this week with my coaches, Phil was at the top of the list again, but for something quite different.

Phil is a regular attendee in our Trader Acceleration Sessions that we have 3 times per week for Trader Success System members. In these sessions, my students bring their questions and challenges and we resolve them face-to-face over Zoom.

The great thing about this is regular attendance really builds your skills fast, and in Phil’s case this is really showing as he has been helping the community and answering many of the questions other members have – brilliantly showcasing his own knowledge and skill development.

I love seeing my members grow from being new and uncertain into being confident and knowledgeable traders able to help others accelerate their trading journey.

Keep it up Phil – awesome work!!!

News from EST

For those of you in The Crypto Success System I have some exciting news for you…

We are launching The Crypto Automation Engine for Kucoin NEXT WEEK!!!

This means if you trade on Binance and / or Kucoin your trading can be fully automated by subscribing to The Crypto Trade Automation Engine.

If you have been on the sidelines about trading crypto because of the time commitment or the concern about it being a 24/7 market, now is the time to get in. Once you join The Crypto Success System and learn the systems, upgrade to The Crypro Trade Automation Engine and you will be able to put your crypto trading on autopilot!

Just one more announcement on the EST front…

Next week (April 4th at 2pm EDT) I will be presenting in the Interactive Brokers Webinar series on “The Uses and Abuses of Optimization in Systematic Trading”

This is the first time I am presenting for Interactive Brokers and I am super excited about it… Don’t miss it. Click here to register!

On the Home Front

Today is the last week of the first term of the school year and I have to say I am pretty proud of the kids for their huge efforts this term. Between them they are doing more extracurricular activities than I can count, killing it in class and have just been all round awesome this term.

Next week they are off to school camp so we are childless for a week … well assuming you don’t count Gizmo – he would miss his daddy too much if he went to camp…

I feel very lucky right now… and even if I have a down moment Gizmo is always happy to see me.

I had a powerful conversation with Stephanie our very own Certified High Performance Coach here at EST (and my wonderful wife – in case you are new around here) this week about ENERGY. I have been pushing pretty hard in the Enlightened Stock Trading business because there are so many things that I really want to do with the business and there are so many people to help.

However, the conversation made me realize that I need to be careful to manage my energy levels by building in more recharge time, more fun and a bit more sleep. I realized I would be no good to anyone if I start feeling burnt out! So I have adjusted a few things, am learning to relax a bit about my goals for EST and as Tom Basso says – remembering to ‘Enjoy the ride’.

How are you managing your Energy levels?

I would love to hear from you – comment on this newsletter and let me know you read it and I would love to hear how your trading is going!

Hope to hear from you soon 🙂

Adrian

Founder – Enlightened Stock Trading

Share This

Share this post with your friends!